The gaming world is a battlefield, and few fronts are as hotly contested or as fascinating to observe as the Competitive Landscape and Market Position of Next-Gen Xbox. While Microsoft's green machine has undeniable strengths, recent data paints a complex picture, revealing both the immense potential and pressing challenges facing Xbox as it navigates a rapidly evolving industry.

At a glance: What You'll Learn About Next-Gen Xbox

- Current Standing: Xbox trails PlayStation and Nintendo significantly in global console market share (23% vs. PS's 45% and Nintendo's 27%).

- Hardware Headwinds: Despite a dual-console strategy, Xbox Series X/S sales (around 32.77 million units by March 2025) are dwarfed by PlayStation 5 (over 74 million units).

- Strategic Paradox: Microsoft is a top game publisher by revenue, partly by releasing first-party titles on rival platforms, which helps software sales but hurts Xbox hardware appeal.

- Game Pass Power: The subscription service boasts 34 million subscribers and is a major revenue driver, but its broad accessibility might inadvertently reduce the urgency to buy an Xbox console.

- Key Challenges: Studio closures, developer frustration with the Series S parity, weak international sales (especially Japan and Europe), and consumer anxieties about digital ownership are significant hurdles.

- Pathways Forward: Redefining exclusivity, evolving Game Pass to drive hardware, streamlining future console strategy, deeper international investment, and leveraging AI/cloud are critical for resurgence.

Navigating the Shifting Sands: Xbox's Current Position

For years, the console wars have captivated gamers and industry observers alike, often distilled into a fierce rivalry between Sony's PlayStation and Microsoft's Xbox. While the narrative often simplifies to a head-to-head battle, the reality of early 2025 shows a more nuanced, and for Xbox, a more challenging competitive landscape. Data reveals a significant gap in market penetration, with Xbox holding a global console market share of 23%, trailing PlayStation at 45% and Nintendo at 27%.

The numbers paint a stark picture: by February 2025, PlayStation 5 had sold an impressive 74.15 million units worldwide. In contrast, the combined sales of Xbox Series X/S reached approximately 32.46 million units by February 2025, nudging up to 32.77 million by March. This disparity isn't just a cumulative figure; monthly sales in March 2025 showed PlayStation 5 capturing nearly 70% of new console sales, leaving Xbox Series X|S with just over 30%. This isn't just a statistical blip; it reflects deep-seated trends and strategic challenges that Xbox must confront head-on.

The Regional Puzzles: Where Xbox Faces its Toughest Battles

Beyond global figures, Xbox faces particularly acute struggles in key regional markets. In 2024, the brand sold fewer than 3 million units across the critical US and European markets combined – approximately 2.7 million in the US and a meager 290,000 in Europe. These numbers are concerning, especially considering Europe saw Xbox sales plummet from 550,000 units in 2023 to 290,000 in 2024, leading to necessary price cuts in the face of strong PlayStation competition and rising costs.

Perhaps no region exemplifies Xbox's uphill battle more than Japan. Persistent low sales are attributed to a strong consumer preference for JRPGs and narrative-driven games, deep-seated loyalty to domestic brands like Sony and Nintendo, and historical missteps by Microsoft. The recent closure of Tango Gameworks, Microsoft's sole Japanese studio and the creator of the critically acclaimed Hi-Fi Rush, has further exacerbated concerns, damaging trust and signaling a potential deprioritization of unique content relevant to this crucial market.

What the Competition Does Differently: Lessons from PlayStation and Nintendo

To understand Xbox's position, it's essential to examine the formidable strengths of its rivals. PlayStation, under Sony, maintains its dominance through a consistent lineup of high-quality, impactful exclusive games. Titles like Marvel’s Spider-Man 2 and God of War Ragnarök aren't just great games; they are "system sellers" that provide compelling reasons to choose PlayStation hardware. Coupled with effective marketing, Sony has cultivated a strong brand perception centered around premium, story-driven experiences.

Nintendo, on the other hand, carves out a unique market position by eschewing direct competition on graphical prowess. Their success stems from innovative hardware design, exemplified by the hybrid nature of the Switch, and an unrivaled catalog of iconic, family-friendly intellectual property like Mario, Zelda, and Pokémon. Nintendo also stands out by continuing to support physical media alongside digital offerings, catering to a segment of consumers who value tangible ownership and collectability. This dual strategy helps secure their robust lifetime sales, with the Switch reaching nearly 150 million units by February 2025.

Xbox's Strategic Crossroads: Unpacking the Challenges

Microsoft's Xbox division is operating within a complex, often contradictory strategic framework. While aiming for broad ecosystem reach, some of its key initiatives inadvertently undercut the appeal of its dedicated console hardware.

The Multi-Platform Paradox: Exclusives Under Scrutiny

Microsoft has invested billions in acquiring major publishers, notably ZeniMax (Bethesda) for $7.5 billion and the colossal Activision Blizzard acquisition. These moves were widely seen as a bid to bolster Xbox's first-party exclusive lineup. However, an increasing number of these first-party titles – including critically acclaimed games like Pentiment and Hi-Fi Rush, alongside others like Sea of Thieves and Forza Horizon 5 – are now appearing on competing platforms. While this strategy undeniably maximizes overall software revenue (making Microsoft the world's top game publisher by revenue in December 2024, largely from non-Xbox platforms), it fundamentally diminishes the unique incentive for consumers to purchase an Xbox console. If the best games are available everywhere, why choose Xbox hardware?

Studio Uncertainty and Developer Morale

Recent studio closures, such as Arkane Austin (responsible for Redfall) and Tango Gameworks, send unsettling signals throughout the industry and within Microsoft's own creative ecosystem. Such decisions, even if driven by business realities, create uncertainty for remaining internal studios, damage developer morale, and can lead to a perception that unique or niche content is deprioritized in favor of broader, potentially less distinctive offerings. This can make it harder to attract and retain top talent crucial for future innovation.

The Game Pass Double-Edged Sword

Xbox Game Pass is undeniably a jewel in Microsoft's crown, boasting 34 million subscribers by early 2024 and driving significant content and services revenue (+8% year-over-year in Q3). It offers incredible value, making a vast library of games accessible across console, PC, and cloud. However, its very accessibility across multiple platforms may inadvertently de-incentivize dedicated Xbox console purchases. If the core Game Pass experience is available on PC, on mobile via cloud streaming, or even on smart TVs, the need for a specific Xbox Series X or S console lessens for many potential subscribers. Concerns about the impermanence of digital libraries and the lack of true ownership within a subscription model also persist among some consumers, contrasting with the psychological ownership physical media can provide.

The Dual-Hardware Dilemma: Series X/S

Microsoft's dual-hardware strategy with the powerful Series X and the more affordable, digital-only Series S aimed to broaden market appeal. Indeed, the Series S often outsells the Series X, representing approximately 45% of new Xbox hardware sales, serving as a crucial low-cost entry point. Yet, combined Series X/S sales still significantly trail the PlayStation 5. The "Series S parity requirement" – meaning games must run acceptably on the less powerful Series S – has also created frustration for some developers. This requirement can lead to optimization hurdles and even delays for highly anticipated titles (e.g., Baldur’s Gate 3, Black Myth: Wukong), potentially impacting the perceived graphical capability and overall technical prowess of the flagship Series X, which is theoretically capable of much more.

Brand Perception: Price, Trust, and Digital Ownership

A brand's standing is built on trust and perceived value. Xbox faces challenges on both fronts. Price increases for consoles and future first-party AAA games ($80 starting Holiday 2025) are occurring amidst declining hardware sales and a perceived weakening of exclusive content value. This confluence of factors risks alienating price-sensitive consumers. Furthermore, Xbox's aggressive digital-first strategy, particularly with the digital-only Series S, intensifies consumer anxieties about true digital game ownership. In an era where physical media is declining (digital accounted for 95.4% of global game revenue in 2024, and 84% for console specifically), consumers increasingly worry about the long-term accessibility of their digital libraries, the ability to resell games, and the fundamental concept of "owning" something purely digital.

A Glimmer of Hope? The Ecosystem's Undeniable Strengths

While the current market data presents a challenging scenario, it’s crucial to acknowledge the inherent strengths and successes that Xbox has cultivated. Some analysts, particularly looking at earlier performance trends like mid-2023, point to substantial achievements and a robust ecosystem that, if leveraged correctly, could still drive future growth. Indeed, the global gaming market is expected to exceed $250 billion by 2025, and Xbox remains a key player within it.

The Power of the Ecosystem: Game Pass and Cloud Dominance

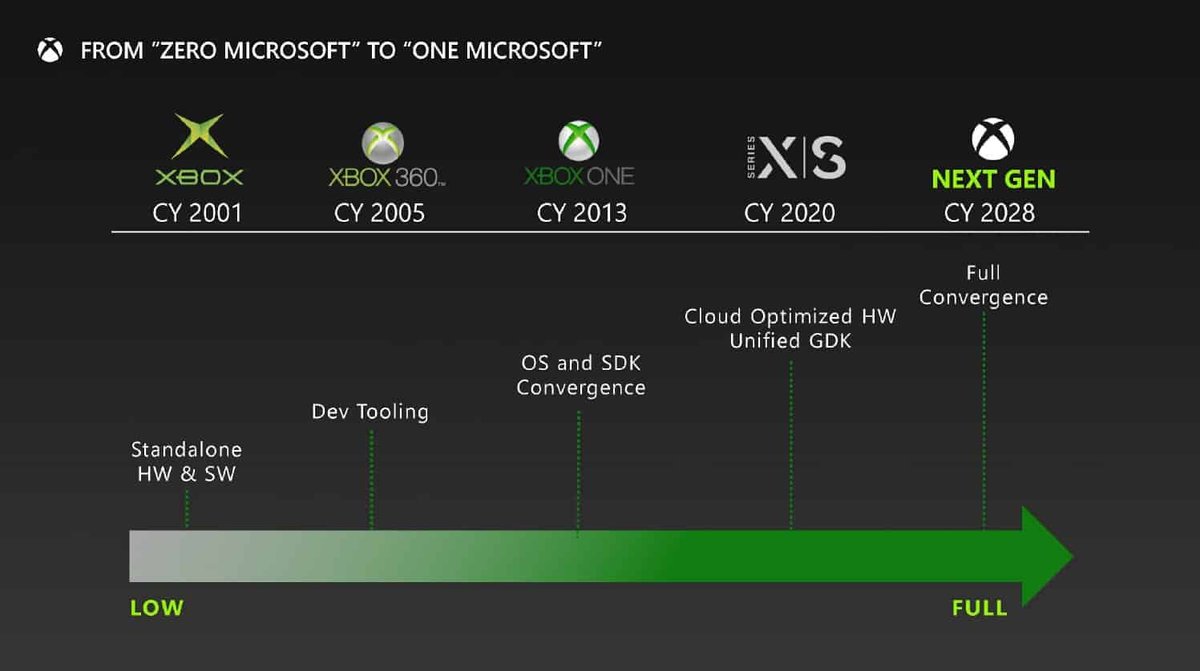

Even with its double-edged nature, Xbox Game Pass is a foundational success. It has not only cultivated a dedicated user base (exceeding 30 million by mid-2023, a 50% increase year-over-year) but also successfully capitalizes on the growing consumer preference for subscription models. An early 2023 survey showed over 60% of gamers preferred subscriptions over individual purchases. This service, combined with aggressive pushes into cloud gaming via Xbox Cloud Gaming, positions Microsoft at the forefront of evolving consumer experiences and attracts a wider audience beyond traditional console owners. The AMD Microsoft Xbox next-gen insights will surely be crucial in strengthening this cloud infrastructure and the underlying hardware.

Hardware Innovation and Backward Compatibility

The Xbox Series X and S, launched in November 2020, leverage custom-designed processors and SSD technology to deliver quicker load times and immersive experiences. While the sales figures lag behind PlayStation, the technological foundation is solid. Furthermore, Xbox's commitment to backward compatibility, allowing players to enjoy games from previous generations, adds significant value for long-time fans and new players discovering a vast library. This focus on preserving gaming history and providing choice is a strong community builder.

Inclusivity, Community, and Strategic Partnerships

Microsoft has made a concerted effort to foster an inclusive gaming community through initiatives promoting accessibility, diversity, and a strong loyalty program. Cross-platform play has been a hallmark of Xbox's competitive strategy, attracting a broader audience. Strategic partnerships with third-party developers, technology companies, and even integration with Microsoft 365 services enhance the overall Xbox ecosystem, positioning it as a more interconnected digital entertainment hub. These elements, if consistently maintained and expanded upon, can form a powerful foundation for future success.

Charting a Course for Resurgence: Strategic Imperatives for Next-Gen Xbox

To reverse current trends and solidify its market position, Xbox needs a clear, decisive pivot. This isn't just about tweaking existing strategies; it's about a fundamental re-evaluation of its value proposition to consumers and developers.

Redefining the Value of Exclusivity

Xbox must implement a nuanced strategy for its first-party content. Not every game needs to be a console exclusive, but certain "system seller" franchises must be. Identify titles with genuine console-driving potential and either make them true Xbox hardware exclusives or offer significant, multi-year timed exclusivity windows. Balance this with a multi-platform approach for other, less hardware-driving titles to maximize overall software revenue without diluting the Xbox console's unique appeal. Crucially, this means ensuring studio stability, supporting diverse development, and investing in new IP while nurturing established franchises like Halo, Forza, and Gears of War.

Transforming Game Pass into a Hardware Driver

Game Pass is a powerful subscription, but it needs to actively drive hardware sales. Microsoft could introduce Game Pass tiers directly linked to Xbox hardware, perhaps through attractive "Game Pass Ultimate + Console" payment plans that make entry more affordable. Consider console-exclusive benefits or content tiers within Game Pass that are only accessible with Xbox hardware. Additionally, addressing consumer concerns about digital ownership could involve offering "Game Pass Collections" with digital extras like art books and soundtracks, enhancing the perceived value and ownership experience for subscribers.

Streamlining the Hardware Vision

For the next console generation, Microsoft should seriously consider returning to a single, powerful flagship console. This would simplify the value proposition for consumers, streamline development efforts by removing the Series S parity requirement, and allow developers to push the graphical and technical boundaries without compromise, potentially attracting more cutting-edge titles. Alongside this, exploring innovative form factors like a dedicated Xbox-branded handheld device (leveraging cloud capabilities) or a deeper PC-console hybrid could open new market segments. Continued, significant investment in Xbox Cloud Gaming infrastructure and the development of "cloud-native" games designed from the ground up for streaming will also be vital.

Cultivating Global Markets with Precision

Xbox's international market weakness, particularly in Japan and Europe, demands deep, culturally attuned investment. For Japan, this means significantly investing in partnerships with established Japanese developers to create culturally relevant content, especially JRPGs and narrative games that resonate with local tastes. Microsoft should also consider establishing or re-establishing a dedicated Japanese studio. Marketing efforts need deep cultural adaptation, moving beyond a one-size-fits-all approach. In Europe, competitive pricing and leveraging the strengths of Xbox Cloud Gaming, along with tailored marketing campaigns, can help regain lost ground.

Rebuilding Trust with Consumers and Developers

Trust is a fragile commodity. Xbox needs to actively address consumer anxieties about digital ownership. This could involve exploring "digital-to-physical" upgrade paths, implementing transparent preservation policies for digital libraries, and establishing "legacy access" initiatives to ensure purchased games remain playable for decades. Experimenting with blockchain technology for a secure secondary digital game market could also be a forward-thinking solution. For developers, clear, consistent communication on strategic direction, stable studio policies, and fair collaboration models are paramount. Engaging actively with the community and offering desirable physical collector’s editions and merchandise can also foster goodwill and brand loyalty.

Leveraging Microsoft's Broader Tech Stack: AI and Cloud

Microsoft's immense resources in AI and cloud computing (Azure) offer unique advantages. Xbox should aggressively integrate AI for dynamic, personalized gaming experiences, such as adaptive difficulty, intelligent non-player characters (NPCs) that learn and evolve, and highly personalized content recommendations. Intensifying Azure cloud infrastructure investment isn't just for cloud gaming; it's for enabling the next generation of online, persistent, and "cloud-native" games. Developing intuitive, cross-platform user interfaces that seamlessly blend gaming, social, and productivity aspects could also differentiate the Xbox ecosystem.

Addressing Key Questions and Misconceptions

Is Xbox Game Pass actually hurting console sales?

It's a complex situation. While Game Pass is highly successful in generating subscription revenue and growing the overall Xbox ecosystem (34 million subscribers), its widespread availability on PC, mobile, and other devices means many subscribers don't feel compelled to buy an Xbox console. So, while it boosts content revenue, it can inadvertently de-incentivize dedicated hardware purchases.

Why is Xbox struggling so much in Japan?

Xbox has historically struggled in Japan due to strong cultural preferences for JRPGs and narrative-driven games, deep loyalty to domestic brands like Sony and Nintendo, and past marketing missteps. The recent closure of Tango Gameworks, their only Japanese studio, further damages their standing in a crucial market that values local development.

Will Xbox ever go back to making true console exclusives?

The current trend leans towards multi-platform releases for many first-party titles. However, to drive hardware sales, Xbox will likely need to re-evaluate this strategy for its most impactful "system seller" franchises, potentially offering genuine console exclusives or significant timed exclusivity for future next-gen consoles.

What's the deal with the Series S and developer frustration?

The Xbox Series S, while an affordable entry point, is less powerful than the Series X. The requirement for games to run on both consoles means developers sometimes have to optimize for the Series S, which can lead to development challenges, delays, and potentially limit the graphical ambition of games on the more powerful Series X.

Is the future of gaming entirely digital?

While digital sales dominate (95.4% of global game revenue in 2024), a significant segment of consumers still values physical games for ownership, resale, and collectability. Xbox's strong digital-first push, especially with the digital-only Series S, highlights this shift but also raises consumer concerns about true digital ownership and preservation.

The Road Ahead: What's Next for Xbox?

The path forward for Xbox is not simple, but it is clear. The company stands at a pivotal juncture, facing declining hardware market share despite being a powerhouse in overall gaming revenue. To truly dominate the next generation, Microsoft's Xbox division must move beyond its current paradoxes. It requires a renewed, unwavering focus on its core console value proposition, delivering compelling, unique reasons to choose Xbox hardware over rivals or even its own expansive multi-platform ecosystem.

This means strategically deploying its incredible catalog of IP, making tough decisions about exclusivity, and fundamentally rebuilding trust with both its loyal community and the developers who bring its vision to life. By leveraging its technological prowess in AI and cloud, refining its hardware strategy, and making deeply committed, culturally sensitive international investments, Xbox has the potential to redefine its market position. The journey will be challenging, but the opportunity to sculpt the future of gaming remains firmly within its grasp.